Yield Curve Inversion

Yield Curve Inversion

August 15, 2019 by Lesjak Planning

Recent developments in the financial world have led to significant discussion regarding an Inverted Yield Curve and a looming recession. Equity markets around the world responded with a decline in prices. Economists, former Federal Reserve Chairpersons, market pundits, and every individual that can get in front of a camera are offering their opinions – some are qualified and some are not.

As a quick recap, an Inverted Yield Curve means yields on longer term U.S. Treasury Bonds are lower than for shorter term bonds. When bond prices rise, yields decline. Therefore, investors are flocking to longer term bonds for safety (driving up prices) because they feel a recession in the short term will cause the Federal Reserve to lower interest rates. This makes the shorter-term bonds less attractive, which brings their prices down, thereby increasing short term yields. Simply put, investors have lost short term confidence in the economy and want to lock in longer term interest rates.

An Inverted Yield Curve does not mean a recession is starting, but rather points to potential problems developing within the economy. It has historically taken an average of 18 months for these issues to manifest themselves through a decline of economic output. However, that does not mean the equity markets automatically decline. To the contrary, preceding the last 4 economic recessions, the S&P 500 Index has averaged roughly 15% from time of Inversion to the beginning of a recession.

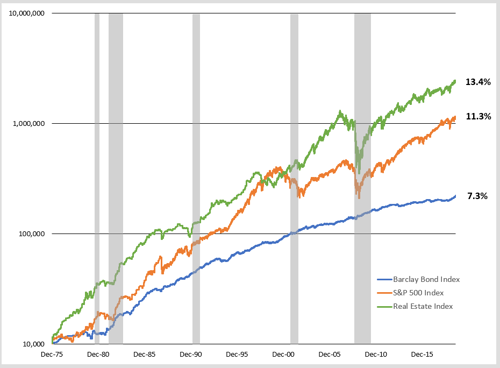

Asset class performance since 1975

*Shaded areas indicate U.S. economic recessions. Past results are no guarantee of future performance.

The longer you are invested in securities, the more likely you are to experience a recession

– it is inevitable and we help you plan for it. The financial plan design, utilizing various asset classes, and retirement distribution strategies each serve to help mitigate the effect of a recession towards your goals and desires.

For example, the Federal Reserve typically cuts interest rates to help avoid or minimize the effects of a recession on the economy. These declining interest rate environments are very beneficial to fixed income investments. With history as a guide, when the Fed reduced rates for the last 3 recessions, fixed income investments accumulated 21% on average with an average annualized gain of 9%.

We expect the media to continue along its traditional course of attention-grabbing headlines, exceedingly short-term focus, and never-ending coverage all with the purpose of generating greater viewership and more online clicks. In the meantime, take stock in the graph below that whatever lies ahead for the economy and investment markets will be overcome through thoughtful planning for your goals and positioning of assets.

About the author

Lesjak Planning