March 15, 2017 Lesjak Planning Perspective

March 15, 2017 Lesjak Planning Perspective

March 15, 2017 by Lesjak Planning

While the first smartphones were actually created in the late 1990’s, it wasn’t until 2007 that Apple famously unveiled its first iPhone and revolutionary touch display. The ten years since saw the smartphone become intertwined with our daily lives because of ingenuity and seemingly limitless applications. It is estimated over one billion smartphones were sold worldwide in 2014 alone.

We bring this to your attention because it is a wonderful example of our society’s constant thirst for innovation. Take into consideration that in recent times we have succeeded in sending a rocket to outer space and then safely landing it standing upright on its launch pad, a house was built with a 3D printer for the economical price of $11,000, electric cars are on the verge of mass production, and there are even “5 dimensional glass discs” about the size of a quarter that can store every book ever written and last for billions of years.

While there are many forces working in our favor right now, a short term pause as part of this long term uptrend may be in order. However, the economic backdrop remains positive as manufacturing continues to show expansion, employment figures are positive and wages are increasing on average. Fortunately, innovation is a key driver for our economy and investment markets and we look forward to what the next decade may bring.

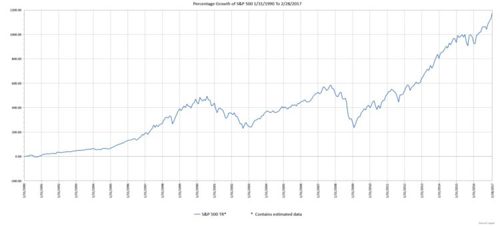

S&P 500 Index since 1990

Innovation can sometimes get ahead of itself and I think we all agree there is such a thing as too much screen time!

Every once in a while we need to take a pause to adjust to new technologies or a new way of doing things. But nonetheless, the innovations keep coming and, for the most part, our societies benefit.

Our investment markets are very similar in that regard. Certainly, equities go through their fair share of bumps along the way, but yet they keep moving forward. From time to time, they too get ahead of themselves and we need to take a pause. Yet, when we take a step back and observe the big picture, equities are extremely resilient and beneficial when managed properly.

The current equity market environment has experienced a rapid pace of price increases over the last several months. Consider that the S&P 500 Index has not experienced a 1% down day in the last 104 trading days – the longest such streak since 1995. Sector rotation has helped fuel this rally with monies flowing from retail and utilities to financials and technology. We have taken advantage of this opportunity by continually reviewing and rebalancing your portfolios when appropriate.

About the author

Lesjak Planning