Keep Your Eye on the Target

Keep Your Eye on the Target

June 15, 2022 by Lesjak Planning

The unfortunate convergence of several factors is driving consumer inflation to its fastest increase since December of 1981 as evidenced by the 8.6% year-over-year increase for May. This puts our Federal Reserve Board in a precarious position to aggressively fight rapidly rising inflation while also attempting to avoid triggering a painful economic recession. Naturally, the great deal of uncertainty has put significant downside pressure on equity and fixed income prices alike.

While we typically relay to you our thoughts during times such as these, below you will find an excerpt from recent commentary authored by Liz Ann Sonders, Chief Investment Strategist for Charles Schwab. We feel her comments echo our current thoughts quite well.

Panic and greed

When it comes to panic, the most obvious example is trying to dump investments when the market is dropping. This is a great way to invert the old adage about buying low and selling high. Never before has information about the economy and markets been more readily available and disseminated; and never before has it been easier (and less expensive) to trade. As a result, our reaction mechanisms are heightened—but not necessarily to our advantage.

Greed can also lead us astray in a number of ways. First, there’s the temptation to load up on aggressive higher-risk assets in the hope of a big payoff. But there is a dark side to an aggressive posture’s potential higher returns: the risk taken in getting there. Aggressive portfolios’ higher historical returns have had a much wider range of returns—that is, a higher standard deviation, with greater “drawdowns,” or peak-to-trough declines, and volatility. And most importantly, those higher returns typically are generated through “stick-to-it-iveness,” not lucky bets.

Then there’s the temptation to try to “time” markets. It’s enticing to try to catch the next big investment wave (up or down) and allocate assets accordingly. But there are very few time-tested tools for consistently making those decisions well.

It’s also important to consider how the two impulses can work together, with yesterday’s greed paving the way to today’s panic. Investors may think they understand their risk tolerance—until they don’t. There’s a big difference between financial risk tolerance (the ability to financially withstand volatile markets) and emotional risk tolerance. The gap between the two is often quite wide and typically becomes evident in tumultuous market environments.

Panic Is Not a Strategy – Nor is Greed

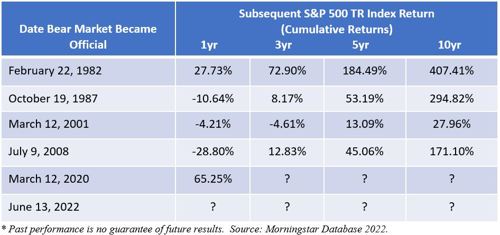

“If markets are good at one thing, it’s reminding investors that stock prices don’t simply go up, uninterrupted, forever. I have updated this report several times since it was initially published in 2008; it’s undoubtedly obvious why I’m doing so again. I do not have a crystal ball and they don’t ring a bell at market tops or bottoms. It’s not what we know, or you know, about the future (path of the stock market) that matters. It’s what we do along the way that matters.

Markets do drop. Bear markets arrive. That’s an unavoidable part of investing. What matters is how you respond. If you’ve built a portfolio that is directly tied to your time horizon and risk tolerance when markets are calm, then a surge in turbulence may not leave you shaken. Good planning, and discipline along the way, is like a pre-emptive dose of Dramamine—it can help neutralize some of the nausea before the turbulence hits.

About the author

Lesjak Planning